A2A Payments vs Card Networks

A comprehensive comparison of modern Account-to-Account payments versus traditional card network infrastructure

A comprehensive comparison of modern Account-to-Account payments versus traditional card network infrastructure

| Feature | payware (A2A) | Card Networks |

|---|---|---|

| Transaction Fee | 0.5% | 2-3% |

| Fixed Per-Transaction Fee | $0.00 | $0.10-$0.30 |

| Settlement Time | Instant | 2-3 days |

| Chargeback Risk | Minimal | High |

| PCI Compliance Required | No | Yes |

| Hardware Required | No | Yes |

| Payment Initiation Methods | 7 methods | 1 method |

| International Standard | Open Standards | Proprietary |

$20,000/month

Save $5,760/year

83% cost reduction

$100,000/month

Save $28,800/year

83% cost reduction

$1,000,000/month

Save $288,000/year

83% cost reduction

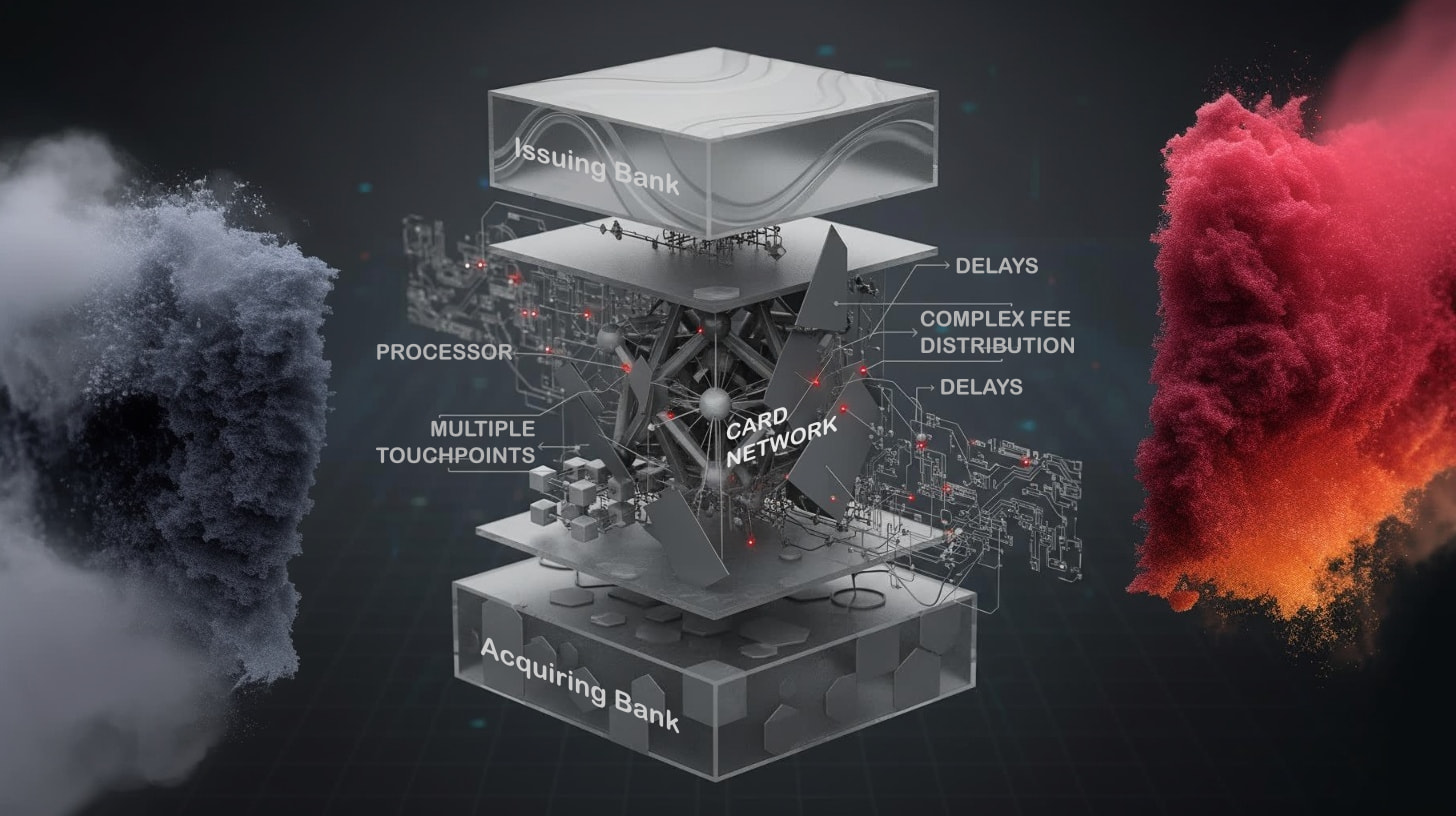

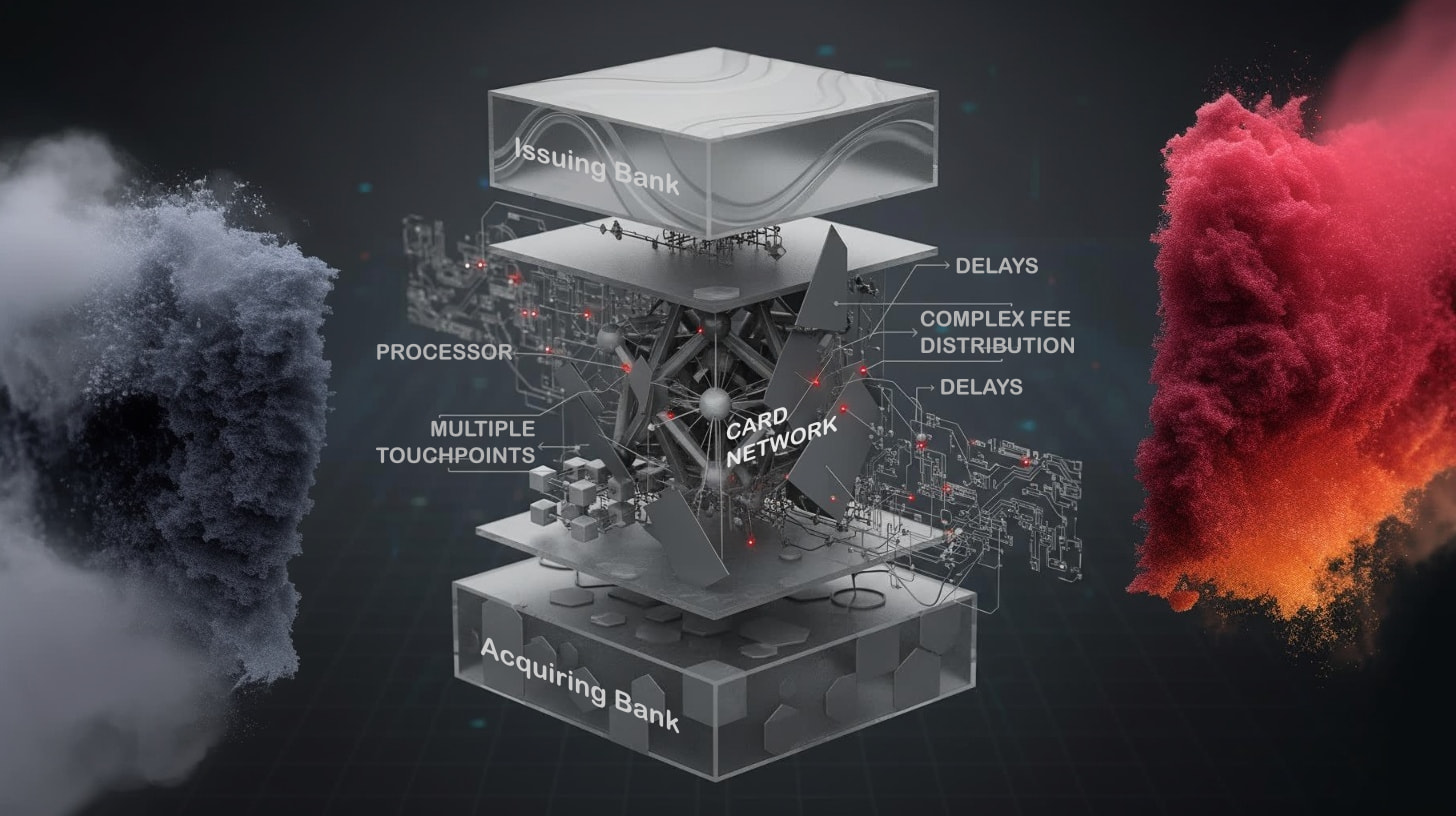

Swipe, tap, or enter card details

First layer of fees (Stripe, Square, etc.)

Visa/Mastercard interchange fees

Customer's bank takes a cut

You finally receive your money

Total Cost: 2-3% + fixed fees

Multiple intermediaries each taking a cut

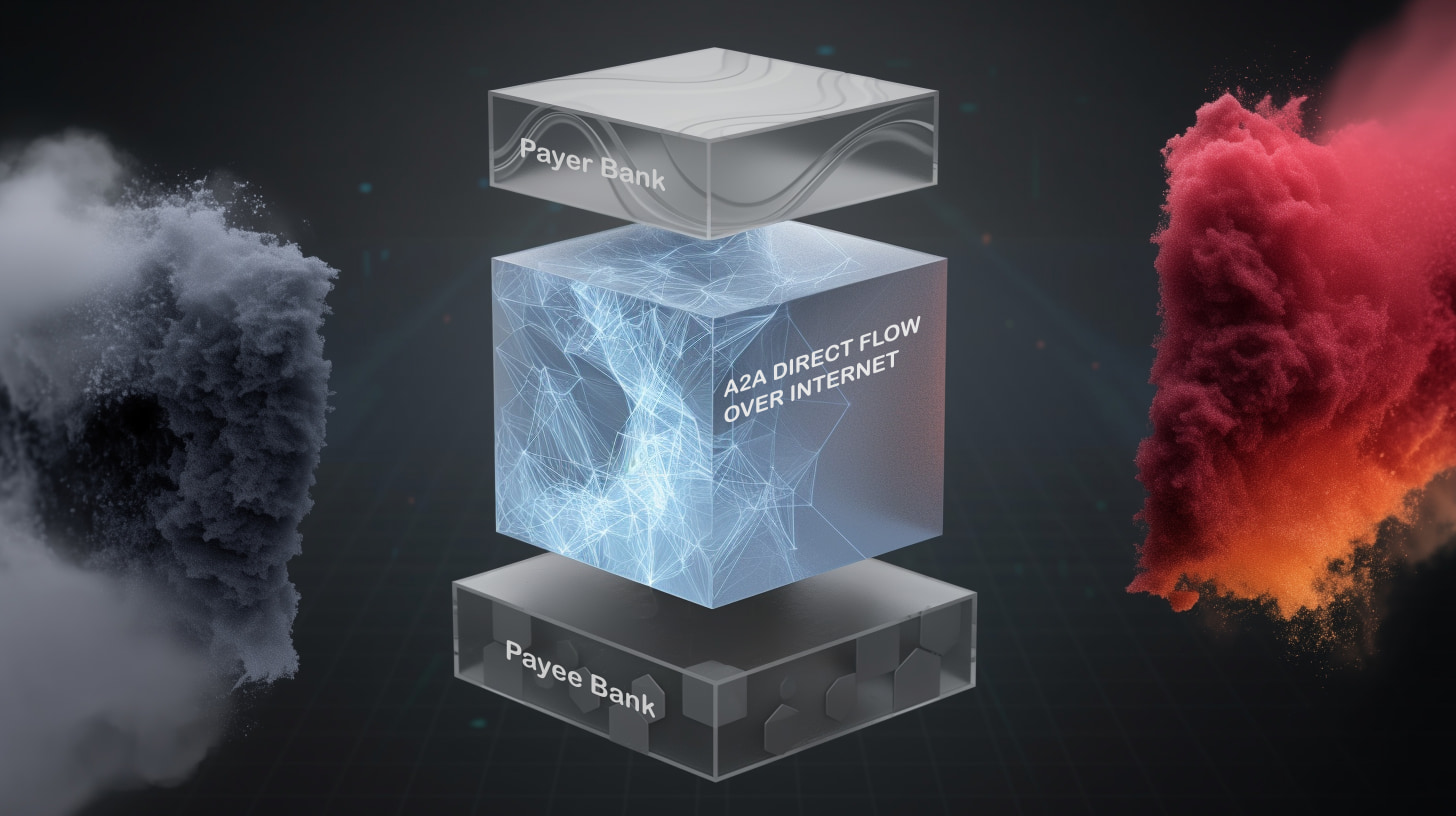

QR, NFC, link, or any of 7 methods

Money moves directly between accounts

You receive your money immediately

Total Cost: 0.5%

No intermediaries, no waiting (rates vary by region)

The bottom line: Eliminating intermediaries reduces costs by 95%+ while improving settlement times from days to seconds.

A2A payments enable innovative revenue streams and business opportunities that traditional card networks cannot support

Create partner ecosystems where ISVs, merchants, and payment institutions share transaction value - impossible with card network fee structures

ISVs can become payment facilitators with white-label solutions, earning recurring revenue from every transaction their platform processes

Build premium services around real-time money movement - merchants pay for instant access to funds, creating new revenue streams

7 initiation methods (QR, NFC, text, link, barcode, BLE, soundbite) enable payments in contexts where cards don't work - events, vending, transit, IoT

Platform economics where payment institutions, ISVs, and merchants all participate in network growth - each new participant increases value for all

Lower transaction costs free up budget for value-added services - fraud detection, customer insights, financial reporting that generates recurring revenue

Eliminate intermediaries, unlock instant settlement, and enable payment experiences cards can't deliver

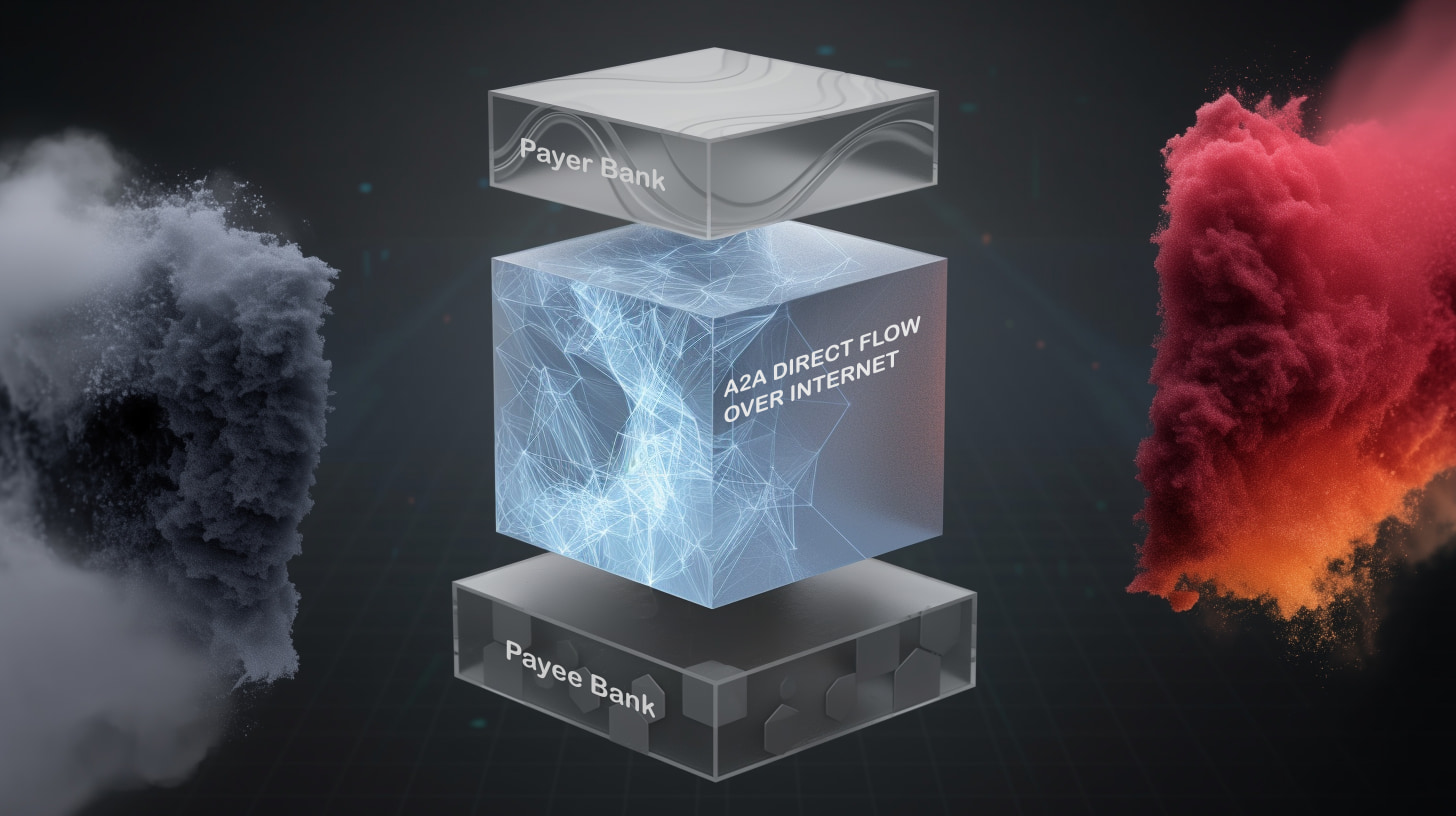

A2A payments are direct transfers between bank accounts without intermediaries like card networks. Money moves directly from the customer's bank to the merchant's bank, eliminating multiple fee layers and enabling instant settlement at significantly lower costs (as low as 0.5% vs 2-3%, rates vary by region).

Card networks involve multiple intermediaries (processor, card network, issuing bank) that each take fees, totaling 2-3% plus fixed fees. A2A payments eliminate these intermediaries, using direct bank transfers starting from 0.5% with no fixed fees (rates vary by region), resulting in significant cost reduction.

Yes, A2A payments use bank-level authentication and Strong Customer Authentication (SCA). Since money transfers directly between banks with real-time authorization, there's minimal chargeback risk compared to cards. No card data is stored or transmitted, eliminating PCI compliance requirements.

payware supports 7 payment initiation methods: QR codes, NFC contactless, text/SMS, payment links, barcodes, BLE (Bluetooth), and soundbite. This flexibility enables payments in contexts where cards don't work well, like events, vending machines, transit, and IoT devices.

Absolutely! Many businesses offer A2A payments through payware for cost savings while maintaining card acceptance as a secondary option. Over time, most customers adopt A2A methods for convenience and speed, naturally shifting transaction volume to the lower-cost option.

Lower costs, faster money, more payment channels, zero chargebacks - all in one platform